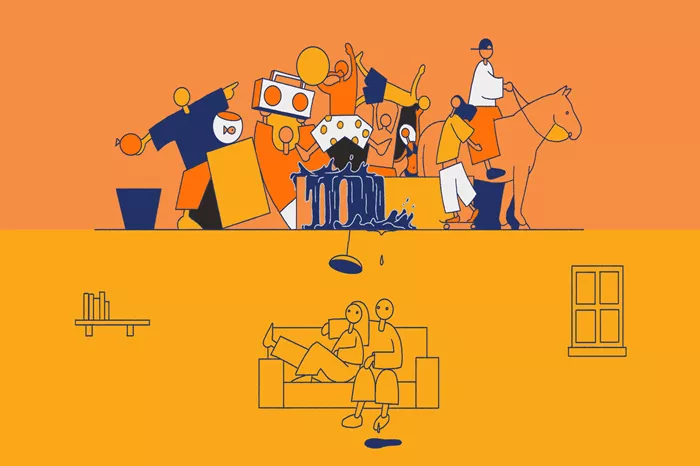

Renters Insurance is a crucial financial safeguard for tenants, protecting them against unforeseen events that could lead to significant financial loss. However, many renters underestimate its importance or overlook its necessity. This article explores the risks and consequences of not having renters insurance.

Understanding Renters Insurance

Renters Insurance Basics:

Renters insurance provides coverage for personal belongings, liability protection, and additional living expenses.

Coverage typically includes protection against losses from fire, theft, vandalism, and certain natural disasters.

Benefits of Renters Insurance:

Personal Belongings Coverage: Covers the cost of replacing or repairing personal items damaged or stolen.

Liability Protection: Covers legal expenses and damages if someone is injured in the rental unit or if a tenant accidentally damages someone else’s property.

Additional Living Expenses: Covers temporary living arrangements if the rental unit becomes uninhabitable due to covered perils.

Risks of Not Having Renters Insurance

Full Cost of Replacement: Without renters insurance, tenants bear the full financial burden of replacing or repairing belongings damaged or stolen. This can include furniture, electronics, clothing, and other personal items.

Tenants may not have sufficient savings to cover these costs, leading to financial strain and potential debt accumulation.

Emergency Fund Depletion: Unexpected losses can deplete tenants’ emergency funds, leaving them unprepared for future emergencies or financial setbacks.

Personal Liability Exposure

Personal liability coverage is a crucial component of renters insurance, offering financial protection in situations where tenants are held responsible for injuries to others or property damage. Understanding this coverage is essential for tenants to grasp the potential risks of not having renters insurance.

Liability Protection

Legal Expenses: Renters insurance covers legal fees, court costs, and settlements if a tenant is sued for accidental bodily injury or property damage to others.

Without this coverage, tenants would have to pay for legal representation out-of-pocket, which can be financially devastating.

Coverage Limits: Policies typically have limits for liability coverage, such as $100,000 or more, ensuring tenants have adequate financial protection against lawsuits.

Higher coverage limits may be necessary for tenants with higher assets or risks.

Medical Payments

Coverage Details: Renters insurance includes coverage for medical payments if a guest is injured in the rental unit, regardless of fault.

This coverage typically reimburses medical expenses up to a certain limit, such as $1,000 or more per person injured.

Protection Against Lawsuits: Medical payments coverage helps prevent guests from suing for injuries sustained on the rental property, promoting goodwill between tenants and visitors.

Examples of Liability Claims

Slip-and-Fall Accidents: A visitor slips on a wet floor in the rental unit and suffers a serious injury. Renters insurance would cover the guest’s medical bills and protect the tenant from liability lawsuits.

Accidental Property Damage: A tenant accidentally starts a kitchen fire that damages neighboring units in the apartment building. Renters insurance would cover the cost of repairing the damage and any legal fees if other tenants or the landlord sue for damages.

Legal Defenses

Legal Representation: Renters insurance typically provides legal representation if a tenant faces a liability lawsuit.

This includes hiring lawyers to defend the tenant in court and negotiating settlements on their behalf.

Peace of Mind: Having renters insurance with liability coverage offers peace of mind, knowing that legal expenses and potential damages are covered in case of an accident or injury on the rental property.

Impact on Temporary Living Arrangements

Temporary living arrangements coverage is a critical component of renters insurance, providing financial support to tenants when their rental unit becomes uninhabitable due to covered perils. Understanding this coverage is essential for tenants to prepare for unexpected disruptions to their living situation.

Alternative Housing:

Cost Coverage: Renters insurance typically covers the cost of temporary housing, including rent, meals, and other necessary expenses, if the rental unit is deemed uninhabitable due to a covered peril like fire, vandalism, or natural disasters.

This ensures that tenants can maintain a reasonable standard of living while their rental unit undergoes repairs or reconstruction.

Duration Limits: Policies may specify a maximum duration for alternative living expenses coverage, such as up to 12 months or more, depending on the insurer and policy terms.

Tenants should review their policy to understand the duration limits and ensure adequate coverage for potential displacement periods.

Additional Expenses Coverage:

Transportation Costs: Renters insurance may cover additional transportation costs incurred due to temporary relocation, such as commuting to work or school from the temporary housing.

Storage Costs: Coverage may extend to storage expenses for personal belongings that cannot be accommodated in the temporary living arrangement.

This ensures that tenants can safely store and access their belongings during the displacement period.

Policy Exclusions:

Uncovered Perils: It’s important for tenants to understand which perils are covered and excluded under their renters insurance policy.

Some policies may exclude certain natural disasters or specific types of damage, potentially impacting the availability of alternative housing coverage.

Policy Limits: Coverage limits may apply to alternative living expenses, so tenants should review their policy limits and consider additional coverage options if necessary.

See Also: What Can You Claim on Renters Insurance

Case Examples:

Fire Damage: After a kitchen fire renders a rental unit uninhabitable, renters insurance covers the cost of a hotel stay and meals for the tenant and their family during the repair process.

Natural Disaster: Following severe storm damage to the rental property, renters insurance provides funds for temporary rental accommodation until the unit is restored to livable conditions.

Preparation and Awareness:

Policy Review: Tenants should review their renters insurance policy annually to ensure it provides adequate coverage for temporary living arrangements.

Emergency Planning: Developing an emergency plan and keeping essential documents, including renters insurance policies, readily accessible can expedite the claims process in the event of a covered loss.

Legal and Contractual Obligations

Understanding the legal and contractual obligations related to renters insurance is crucial for tenants to comply with lease agreements and protect their interests in rental properties.

Landlord Requirements:

Lease Agreement: Many landlords require tenants to maintain renters insurance as a condition of the lease agreement.

This requirement is typically included to protect the landlord’s property and minimize liability risks associated with tenant negligence or accidents.

Policy Details: Landlords may specify minimum coverage limits and types of coverage required, such as personal property coverage and liability protection.

Tenants should provide proof of insurance to the landlord upon signing the lease and renewing the policy annually as required.

Property Damage:

Tenant Responsibility: Without renters insurance, tenants may be personally liable for damages to the rental property caused by negligence, accidents, or covered perils.

This includes damage to the interior structure, fixtures, and appliances provided by the landlord.

Financial Consequences: Tenants without insurance may face significant financial burdens if they are held responsible for repairs or replacements due to accidental damage or loss.

Lease Violations and Legal Consequences:

Lease Violations: Failure to maintain renters insurance as required by the lease agreement can constitute a breach of contract.

Landlords may impose penalties, such as fines or lease termination, for non-compliance with insurance requirements.

Legal Disputes: Disputes over insurance requirements and compliance may lead to legal proceedings, potentially resulting in eviction or legal liabilities for the tenant.

Tenant Rights and Protections:

Policy Coverage: Tenants should carefully review their renters insurance policy to ensure it meets the requirements specified in the lease agreement.

This includes verifying coverage limits, deductibles, and exclusions to align with the landlord’s expectations and legal obligations.

Additional Coverage: Tenants may consider additional coverage options, such as umbrella liability insurance, to supplement renters insurance and enhance protection against unforeseen liabilities.

Tenant-Landlord Relations:

Open Dialogue: Maintaining open communication with the landlord regarding insurance requirements and policy updates can foster positive tenant-landlord relationships.

Tenants should notify the landlord promptly of any changes to their insurance coverage or policy details to ensure compliance with lease terms.

Documentation: Keeping records of insurance policies, correspondence with the landlord, and lease agreements can facilitate resolution of disputes and mitigate legal risks.

Case Studies and Real-Life Examples

Example 1: Financial Protection from Fire Damage

Scenario: A tenant’s apartment suffers extensive fire damage, rendering it uninhabitable. The tenant had renters insurance, which covered temporary living expenses, including hotel accommodations and meals, during the repair period.

Outcome: The insurance policy also covered the cost of replacing damaged personal belongings, alleviating financial strain and allowing the tenant to recover more quickly from the disaster.

Example 2: Liability Coverage for Accidental Injury

Scenario: During a social gathering at a rented apartment, a guest trips and falls, sustaining a serious injury. The injured party files a lawsuit against the tenant, alleging negligence in maintaining a safe environment.

Outcome: The tenant’s renters insurance provided liability coverage, including legal defense costs and settlement expenses. This coverage protected the tenant from significant financial liabilities and legal consequences.

Example 3: Legal Disputes and Non-Compliance

Scenario: A tenant fails to obtain renters insurance as required by the lease agreement. A plumbing issue in the rental unit causes water damage to neighboring apartments, leading to property damage claims from other tenants and the landlord.

Outcome: The tenant faced legal disputes and potential eviction proceedings due to lease violations and failure to comply with insurance requirements. The lack of renters insurance left the tenant personally liable for damages and legal expenses.

Example 4: Natural Disaster Coverage

Scenario: A severe storm causes flooding in a rented condominium, resulting in extensive damage to the tenant’s personal belongings and the rental unit’s interior.

Outcome: The tenant’s renters insurance covered the cost of replacing damaged items and provided alternative housing expenses while the condominium underwent repairs. This coverage ensured the tenant’s financial stability and allowed them to focus on recovery without additional financial stress.

Conclusion

In conclusion, renters insurance is not just a financial product but a critical safety net for tenants. By understanding the risks and consequences of going without renters insurance, tenants can make informed decisions to protect themselves and their assets.