In the complex realm of insurance claims, the concept of excess plays a pivotal role in determining financial responsibilities. For policyholders, especially those involved in accidents where fault is not theirs, understanding the nuances of excess payments is crucial. This essay delves into the intricacies of excess in insurance claims, elucidating its definition, implications, and potential outcomes, while providing insight into avenues for recovery in non-fault scenarios.

Explanation of Excess

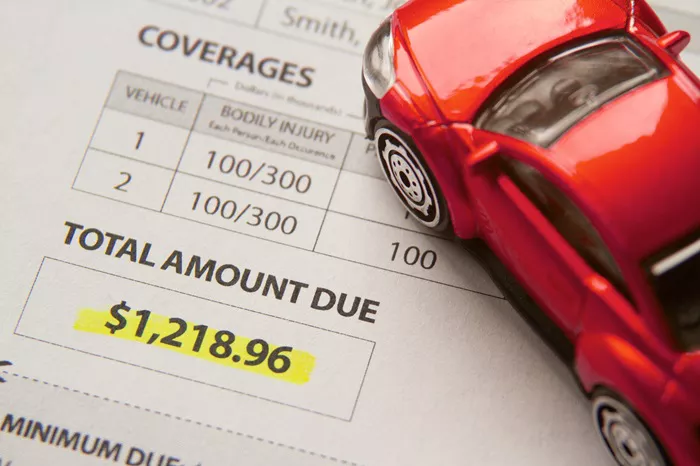

In the lexicon of insurance, excess refers to the amount a policyholder agrees to contribute towards the cost of a claim. It acts as a form of self-insurance, with policyholders opting to pay a certain sum upfront in exchange for lower premium rates. Excess can be categorized into two main types: compulsory and voluntary.

Differentiating Compulsory and Voluntary Excess

Compulsory excess is set by the insurer and is non-negotiable. It is predetermined based on various factors such as the type of policy, the insured vehicle’s specifications, and the policyholder’s history. On the other hand, voluntary excess is at the discretion of the policyholder, allowing them to choose a higher excess in exchange for reduced premiums.

Initial Payment of Excess

Regardless of fault, policyholders are typically required to pay the excess upfront when making a claim. This upfront payment serves as a financial commitment towards the resolution of the claim and is independent of the determination of fault. While this may seem burdensome, especially in cases where the policyholder is not at fault, it is a standard procedure in insurance claims.

Fault Determination

Fault determination is a critical aspect of insurance claims, influencing the ability to reclaim excess payments. In situations where the policyholder is not at fault, there exists the possibility of recovering the excess from the third party’s insurer. However, if fault is attributed to the policyholder, reclaiming the excess becomes less straightforward and may require negotiations with their own insurer.

Role of Insurers

Insurers play a pivotal role in the process of reclaiming excess payments. Upon establishing fault, insurers engage in negotiations with the at-fault party’s insurance company to recover not only the excess but also other associated costs. This intricate process underscores the importance of clear communication and documentation between policyholders and their insurers.

Accident Management Companies

In the aftermath of an accident, policyholders may opt to enlist the services of accident management companies. These entities specialize in managing the entire claims process on behalf of the policyholder, alleviating the administrative burden and potentially circumventing the need to pay an excess upfront. However, it’s essential to carefully evaluate the terms and conditions of such services to ensure alignment with individual needs and preferences.

Recovery of Excess

The process of recovering excess payments hinges on various factors, including fault determination and the cooperation of involved parties. If the policyholder is deemed not at fault, the likelihood of reclaiming the excess from the third party’s insurer is significantly higher. However, this process may entail some degree of patience and persistence, as delays in liability acceptance by the third party’s insurer are not uncommon.

Customer’s Options

In the wake of a non-fault accident, policyholders are presented with a range of options that can influence the trajectory of the claims process. From opting to pursue excess recovery independently to engaging the services of accident management companies, each choice carries its own set of considerations and implications. It’s imperative for policyholders to weigh these options carefully, taking into account factors such as time constraints, financial implications, and personal preferences.

Potential Outcomes

In the dynamic landscape of insurance claims, potential outcomes are subject to various variables and contingencies. Delays in liability acceptance by the third party’s insurer can prolong the resolution process, testing the patience and resilience of policyholders. However, with proactive communication, diligent documentation, and a clear understanding of rights and responsibilities, policyholders can navigate through uncertainties with greater confidence and clarity.

Conclusion

The intricacies of excess in insurance claims underscore the importance of informed decision-making and proactive engagement with insurers and other relevant parties. While navigating the aftermath of an accident, policyholders must remain vigilant, advocating for their rights and leveraging available resources to ensure a fair and expedient resolution. By understanding the nuances of excess and exploring avenues for recovery, policyholders can mitigate financial burdens and navigate through the claims process with greater ease and confidence.

FAQs about Navigating Non-Fault Claims and Excess

1. Do I get my excess back in a non-fault claim?

In non-fault claims, there is a possibility of getting your excess back. If the fault lies with the other party involved in the accident and their insurance company accepts liability, you may be able to recover your excess from their insurer. However, the process can vary depending on the circumstances of the accident and the policies of the insurance companies involved.

2. How does insurance work when it’s not your fault?

When you’re not at fault in an accident, your insurance company may still be involved in the claims process, especially if you choose to make a claim on your own policy for repairs or other expenses. Your insurer will typically liaise with the other party’s insurance company to determine liability and seek reimbursement for any costs incurred, including your excess.

3. Do I have to pay excess if not my fault budget direct?

Generally, yes, you may still be required to pay the excess upfront even if the accident is not your fault, depending on the terms of your insurance policy with Budget Direct. However, if the fault lies with the other party and their insurer accepts liability, you may be able to recover the excess from their insurer through a non-fault claim.

4. Have you been in an accident that wasn’t your fault?

If you’ve been involved in an accident where you believe you’re not at fault, it’s essential to gather evidence at the scene, such as photographs, witness statements, and the other party’s details. Contact your insurance company as soon as possible to report the incident and seek guidance on the next steps, including making a claim and potentially recovering your excess.